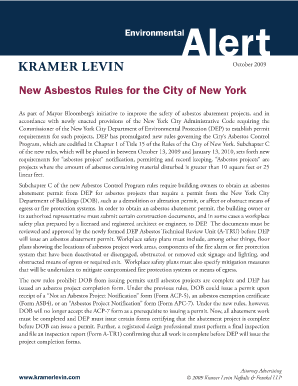

Get the free irs form 14204

Show details

Form 14204 (May 2011) Tax Counseling for the Elderly (THE) Program Application Checklist and Transmittal CONTACT INFORMATION Name of Organization: Address of Organization: Telephone: Point of Contact

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your irs form 14204 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your irs form 14204 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing irs form 14204 online

Follow the steps down below to take advantage of the professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit irs form 14204. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

How to fill out irs form 14204

How to fill out IRS form 14204:

01

Start by gathering all the necessary information and documents required to complete the form. This may include your personal information, income details, and any relevant deductions or credits you qualify for.

02

Carefully read and follow the instructions provided with the form. These instructions will guide you through each section, explaining what information is required and where to enter it.

03

Begin with the basic information section, entering your name, address, and Social Security number. Double-check this information for accuracy before proceeding.

04

Move on to the income section, where you will report your earnings from various sources. This may include wages, dividends, interest, or any other income you received during the taxable year.

05

Next, proceed to the deductions and credits section. Here, you can claim any eligible deductions or credits that may help reduce your tax liability. Make sure to provide accurate and supporting documentation for each deduction or credit claimed.

06

If applicable, complete any additional sections specific to your situation. For example, if you are claiming a specific type of credit or reporting foreign income, there may be additional schedules or forms that need to be filled out and attached to Form 14204.

07

Review the completed form thoroughly to ensure all information is accurate and entered correctly. Mistakes or omissions can lead to delays or penalties. Consider seeking professional assistance or consulting the IRS if you are unsure about any specific sections.

08

Once you are confident that all information is correct, sign and date the form. Include any required attachments or schedules as instructed by the form's guidelines.

Who needs IRS form 14204:

01

Taxpayers who have a specific need to disclose information related to transfer pricing or advance pricing agreements may need to fill out IRS form 14204.

02

This form is typically required for businesses engaged in cross-border transactions or multinational enterprises, as it helps the IRS understand and evaluate the transfer pricing policies applied by these entities.

03

It is important to note that not all taxpayers will need to fill out IRS form 14204. Its usage is typically limited to specific situations where transfer pricing is a significant factor in taxable transactions.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is irs form 14204?

IRS Form 14204 is a form used by employers to apply for the Voluntary Classification Settlement Program (VCSP). The program allows employers to reclassify workers as employees for future tax periods, which can result in significant savings in employment taxes.

Who is required to file irs form 14204?

IRS Form 14204 is required to be filed by any person or business that pays $600 or more to an individual for services performed in the course of their trade or business during the calendar year.

How to fill out irs form 14204?

Form 14204 is an IRS form used to apply for an Employee Identification Number (EIN). To fill out Form 14204, you will need to provide the required information including legal name of the business, mailing address, type of business entity, contact information, and other relevant information. Be sure to provide accurate information and sign and date the form. Once you have completed the form, submit it to the IRS.

What is the purpose of irs form 14204?

IRS Form 14204 is an online form used to report a suspicious activity or transaction that you believe may be related to tax fraud or money laundering. The purpose of the form is to provide information to the Internal Revenue Service (IRS) that may help them identify potential tax fraud or money laundering activities.

What information must be reported on irs form 14204?

IRS Form 14204 is used to report changes in taxpayer identity information. This includes the taxpayer's name, address, Social Security number, filing status, and any other relevant information.

How do I make changes in irs form 14204?

pdfFiller not only lets you change the content of your files, but you can also change the number and order of pages. Upload your irs form 14204 to the editor and make any changes in a few clicks. The editor lets you black out, type, and erase text in PDFs. You can also add images, sticky notes, and text boxes, as well as many other things.

Can I edit irs form 14204 on an iOS device?

You can. Using the pdfFiller iOS app, you can edit, distribute, and sign irs form 14204. Install it in seconds at the Apple Store. The app is free, but you must register to buy a subscription or start a free trial.

How do I fill out irs form 14204 on an Android device?

Complete your irs form 14204 and other papers on your Android device by using the pdfFiller mobile app. The program includes all of the necessary document management tools, such as editing content, eSigning, annotating, sharing files, and so on. You will be able to view your papers at any time as long as you have an internet connection.

Fill out your irs form 14204 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.